are charitable raffle tickets tax deductible

Unfortunately its 3. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

How To Give Money To Charity Tax Effectively Investors Chronicle

Are Charity Raffle Tickets Tax Deductible.

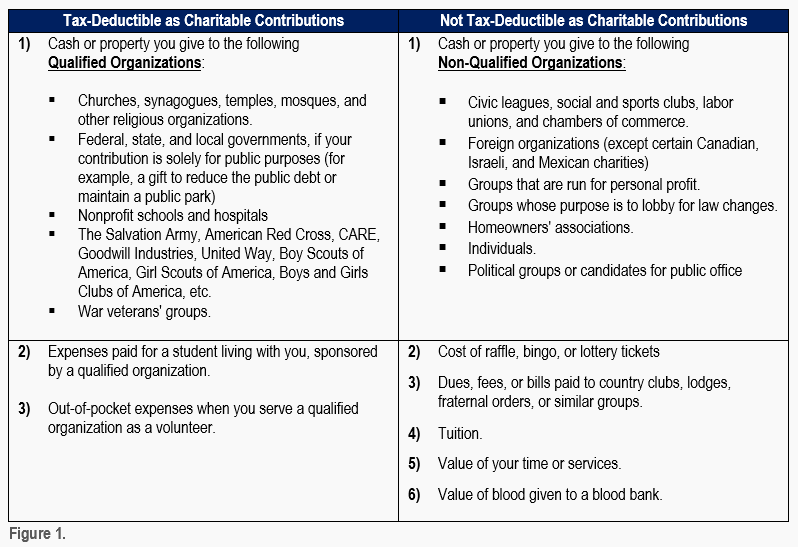

. The portion of the admission or ticket price that equals the value of goods or services the donor receives at the event is not deductible. Payments to a charity in return for services rights or goods are not gifts to charity and so are not eligible for the Gift Aid Scheme. Withholding Tax on Raffle Prizes Regular Gambling Withholding.

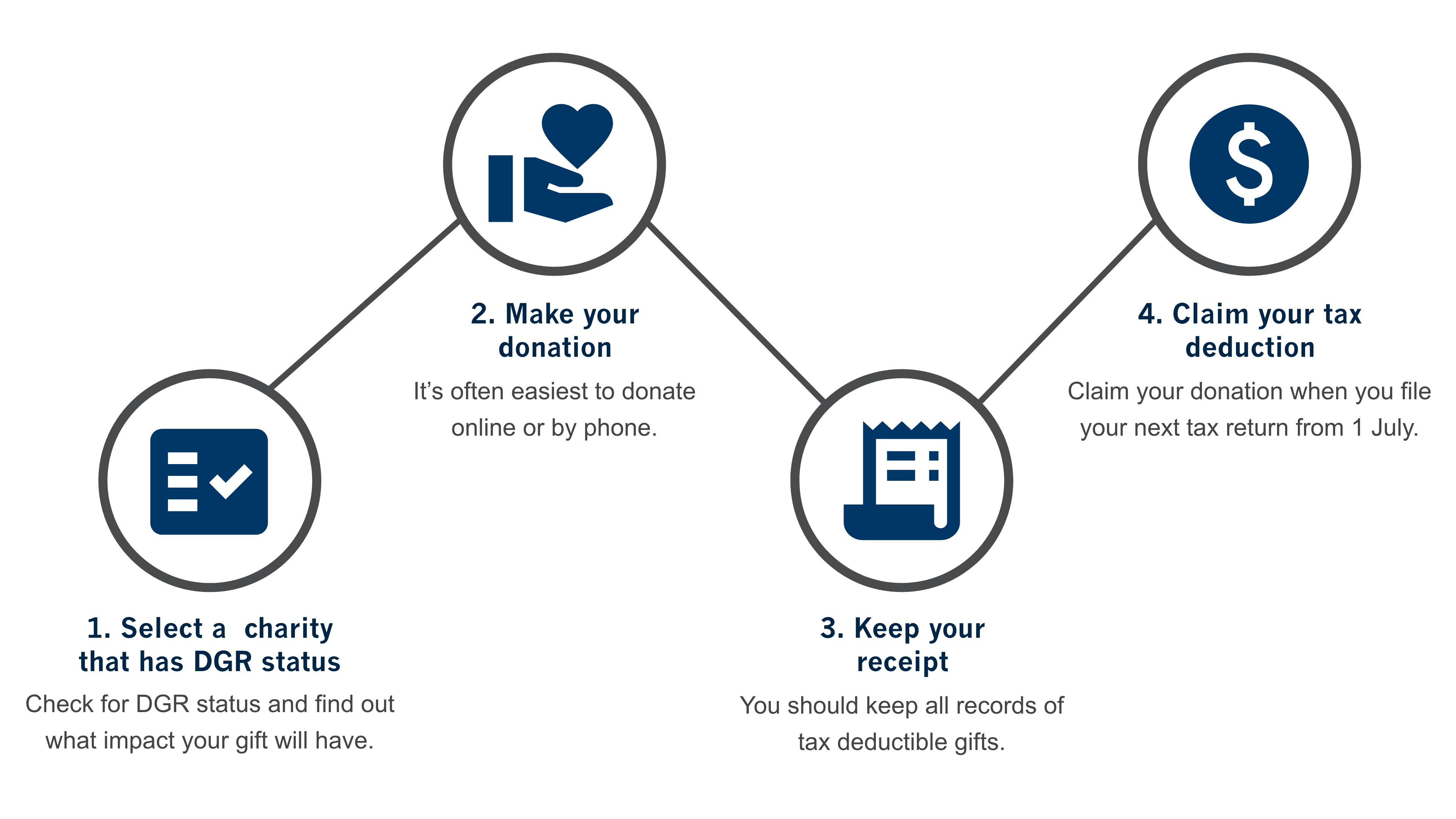

A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts. For example if the ticket price is 100 and the fair. When you purchase a book of raffle tickets from a charity you are receiving something of material value in.

The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. Also if the amount of your contribution depends on the type or size of apartment you will occupy it isnt a charitable contribution. This is because the purchase of raffle.

Unfortunately support via our raffle games are not tax deductible. Many charities will indicate how much of the price you can treat as a charitable deduction right on the ticket. For the purpose of determining your personal federal income tax the cost of a raffle ticket is not deductible as a charitable contribution.

Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its. Buying a ticket lets you help your community but it doesnt help you claim a deduction for a charitable donation. The irs doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses.

Raffle Tickets even for a charity are not tax-deductible. Not all charities are DGRs. If the organization fails to.

It may be deductible as a gambling loss but only up to the amount of any gambling winnings from that tax year. Raffles tickets are not deductible expenses if you help a nonprofit organization with them. Chapter 345 of HMRCs Gift Aid guidance states.

Raffle Tickets may not be deductable when sold as charitable gifts from nonprofit organizations even if its in the nonprofit organizations name. Costs of raffles bingo lottery etc. A tax deductible donation is an amount of 2 or more that you.

An organization that pays raffle prizes must withhold 25 from the winnings and report this. Is the cost of raffle tickets tax deductible. For example in recent times crowdfunding campaigns have.

Some donations to charity can be claimed as tax deductions on your individual tax return each year. The reason why is that you are. If you itemize you can only deduct gambling losses against winnings and youre not allowed to claim raffle or lottery tickets as a charitable deduction.

Raffles are a classic fund-raiser for charities and schools. If you donate property to be used as the raffle prize itself its value may be deductible as a charitable. Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets.

For a donation to be tax deductible it must be made to an organisation endorsed as a. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by. For example if you paid 100 for the ticket and it states that your donation is 60.

Are Tickets To A Charity Dinner Tax Deductible Uk Ictsd Org

Tax Relief For Charitable Donations

Tax Deductible Donations Reduce Your Income Tax The Smith Family

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Template Donation Letter Donation Thank You Letter

Pin Taulussa Sponsorship Letter

Tax Relief For Charitable Donations

Charitable Deductions On Your Tax Return Cash And Gifts

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball

Are Raffle Tickets Tax Deductible The Finances Hub

Are Raffle Tickets Tax Deductible The Finances Hub

Complete Guide To Donation Receipts For Nonprofits

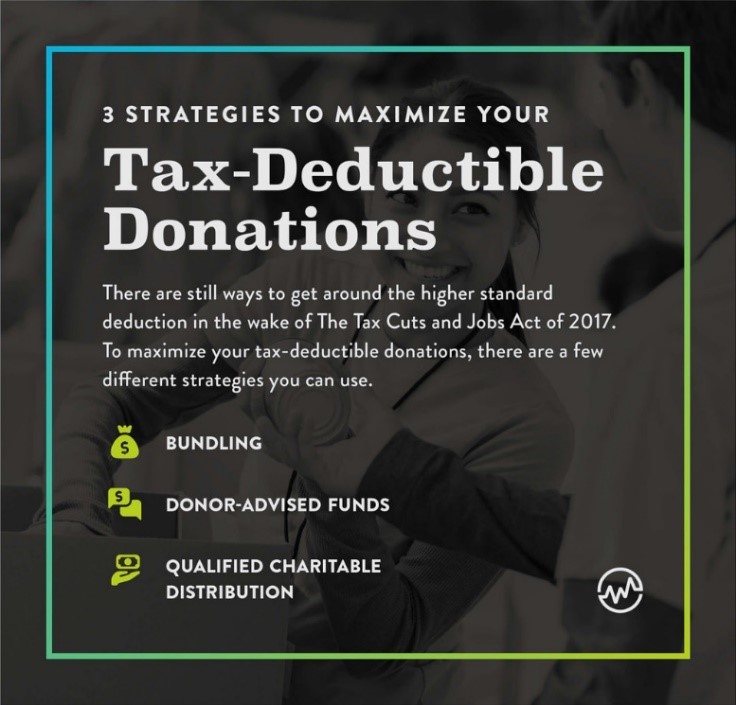

Bundling Can Provide Tax Advantages Catholic United Financial

Tax Deductible Donations An Eofy Guide Good2give

Charity Tax Deductions What Counts As A Contribution The Turbotax Blog